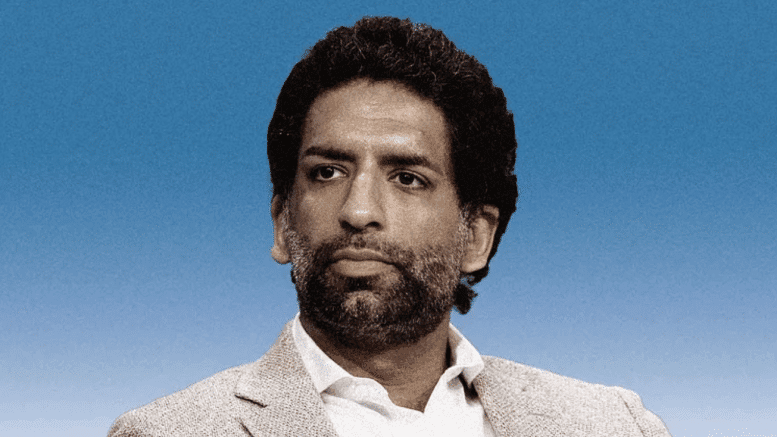

Omeed Malik: The Technocrat Muslim Billionaire Inside MAGA

Omeed Malik is a financier who moved from the donor list of one political lane into dealmaking that intersects with another. He brings a technocrat’s toolkit—networks, capital, and an appetite for influence—to a scene many assumed belonged to grassroots voters. That shift has caught attention because it looks more like economic engineering than traditional partisan realignment.

One striking detail: he “got involved with Rockbridge Network, a conservative donor group started by J.D. Vance and Chris Buskirk, a co-founder of 1789 Capital.” That involvement is concrete, not rhetorical, and it ties him directly to people shaping post-Trump strategy. Those ties matter because they show how money and strategy move faster than party labels.

This is not a simple left-to-right conversion story. The bigger pattern is technocracy—an agenda driven less by social ideology and more by economic architecture. Technocrats trade on systems and structures: regulatory tweaks, finance instruments, and institutional influence that survive political cycles.

Malik’s rise illustrates how those structures work. As a Wall Street figure, he knows how to repackage policy preferences as investment opportunities. Calling it opportunism is fair; calling it strategic integration is more accurate.

The language around Malik has emphasized optics—Hillary donor turned MAGA dealmaker—but the real thread is profit aligned with policy. Turning “anti-woke” sentiment into marketable ventures is a playbook now, not an accident. When political currents create consumer demand, capital follows and productizes the moment.

There’s also a financial doctrine angle that should concern conservatives who care about property, markets, and national sovereignty. Asset-based Islamic finance, which prioritizes asset-backed deals and avoids interest in certain structures, is gaining traction in global banking. When elements of that approach embed in mainstream investment practice, it changes how deals are structured and how risk is allocated.

That shift isn’t inherently sinister, but it is structural. Changes to contract norms, collateral standards, and capital flows reshape incentives across the economy. Conservatives should watch whether these shifts preserve free markets or channel them into new technocratic frameworks controlled by a few.

Malik’s presence inside conservative donor networks shows how quickly elites can reroute influence. The coalition of billionaires and technocrats now spans old political divides, united by economic programs that match their portfolios. For voters who prize authenticity and accountability, that can look like an inside game played by people who never needed the movement on Main Street.

From a Republican point of view, the useful takeaway is simple: alignments of convenience should not replace principle. If capital flows into conservative causes only when it can be monetized or regulated in a particular way, the movement risks becoming a platform for private projects rather than a popular reform engine. Money that shapes policy needs scrutiny equal to the policy itself.

Keep an eye on the mechanisms, not just the headlines. Names and donations make news, but the durable change arrives through contracts, instruments, and institutional partnerships that outlive any one campaign. That’s where technocrats like Malik operate best.