Asset Tokenization: How Ownership Becomes Conditional

You’ve probably heard claims that tokenization will democratize access and make markets fairer, but the change goes much deeper than convenience. Tokenization converts real-world assets—real estate, stocks, bonds, gold, art, and increasingly biometrics, health data, and even human behavior—into programmable digital tokens on blockchains. That shift enables fractional trading around the clock, yet it also creates a technical layer where everything can be tracked and controlled.

Advocates pitch this as progress. Larry Fink, CEO of BlackRock, has repeatedly called it “the beginning of the tokenization of all assets,” claiming efficiency and broader participation. Those gains largely favor issuers and custodians who keep ultimate control while the public holds revocable tokens.

Under today’s systems, traditional ownership still offers a degree of tangible sovereignty: deeds, titles, and legal processes limit instant seizure or remote revocation. Tokenization can replace those protections with programmable access that can expire, freeze, or restrict based on embedded rules. What looks like fractional access can become conditional consumption decided by code and policy.

The legal architecture is already adapting. In July 2025, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) created a federal framework for payment stablecoins with 100% reserves in cash or short-term Treasuries, strict KYC/AML, public disclosures, and bank licensing for issuers. The complementary CLARITY Act (Digital Asset Market Clarity Act) defines qualified issuers, enforces 1:1 backing with audits, and carves out compliant stablecoins from securities rules. Together they make on-chain dollars a bank- or state-approved, fully traceable token, not a free cryptocurrency.

Howard Lutnick, as Commerce Secretary, pushes for dollar-backed stablecoins under tight oversight, where AI and blockchain “transparency” let authorities trace, track, and freeze transactions, framing it as “eliminating crime.” That sounds appealing until you consider the power to lock access at scale. Automated compliance, KYC gateways, and blacklists turn ownership into permissioned use governed by intermediaries.

Institutional voices promote tokenized funds as “the next generation for markets,” with large asset managers driving the shift. The truth is the system concentrates control: platforms and banks custody assets and set the rules, while users hold tokens that can be revoked or constrained. Fractional ownership becomes a continuous revenue stream for institutions and a lever for behavioral enforcement.

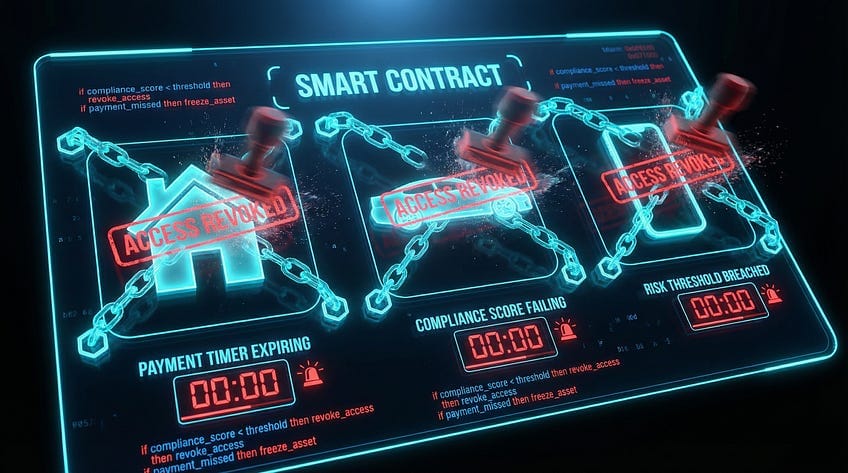

This isn’t an abstract risk; programmability is the point. Tokens are code with the power to enforce expirations, automatic penalties, or access limits tied to risk scores or compliance metrics. Miss a payment, drop below a threshold, or violate a platform rule and your tokenized home, vehicle, or utility access could be locked. Smart contracts make those outcomes automatic and immediate.

Tokenization’s reach is widening into the biological sphere through what many call biodigital convergence. Biometrics, DNA data, neural patterns, and health metrics are being digitized, and pilot programs aim to fold these into financialized systems. Once behavior and biology are tradable data streams, incentives and penalties can be embedded into daily life.

The broader vision echoes the World Economic Forum’s rhetoric and Klaus Schwab’s Fourth Industrial Revolution, even phrases like “you’ll own nothing and be happy.” The danger is not technology alone but the governance layer that couples it with surveillance, scoring, and automated enforcement. That fusion risks turning citizenship and property into service relationships mediated by code and experts.

What starts as improved settlement and broader access can end as a subscription society where durable property rights give way to revocable permissions. Regulators, platforms, and algorithms gain capacity to enforce policy at the protocol level, shifting decisions from democratic institutions to elites and software. The result is a system where convenience masks a long-term transfer of sovereignty into programmable layers of control.