OpenAI Declares “Code Red” as Rivals Close In

Sam Altman is beating his coders like slaves on a ship to row faster. They will all sink together in the end. OpenAI has minuscule income compared to Google and Meta, but Altman has over-committed finances and under-estimated his competition. As a venture capital guy, he can’t personally code his way out of his dilemma. Even Trump’s Genesis Mission EO to financially backstop the entire industry will not help him at this point. ⁃ Patrick Wood, Editor.

OpenAI’s CEO told staff that ChatGPT needs urgent fixes across personalization, speed, reliability and the range of questions it can answer, and he labeled the situation a “code red.” The company plans to refocus engineering efforts toward the core chatbot experience and pause or delay some newer projects. That shift is framed as necessary while competitors close the technical and user-experience gap.

Altman said some initiatives will be deprioritized, including advertising, health and shopping agents, and the personal assistant Pulse. The memo underlined how critical the core product remains as OpenAI spends heavily on data-center capacity. The company is reported to have committed hundreds of billions of dollars to future infrastructure.

OpenAI has opened daily calls for the team working on the chatbot, and Nick Turley, head of ChatGPT, posted on X that the focus is on making GPT “even more intuitive and personable.” The move reflects a sprint to restore user trust and to tighten the product’s behavior. The push is meant to respond quickly to what the company sees as rising competitive pressure.

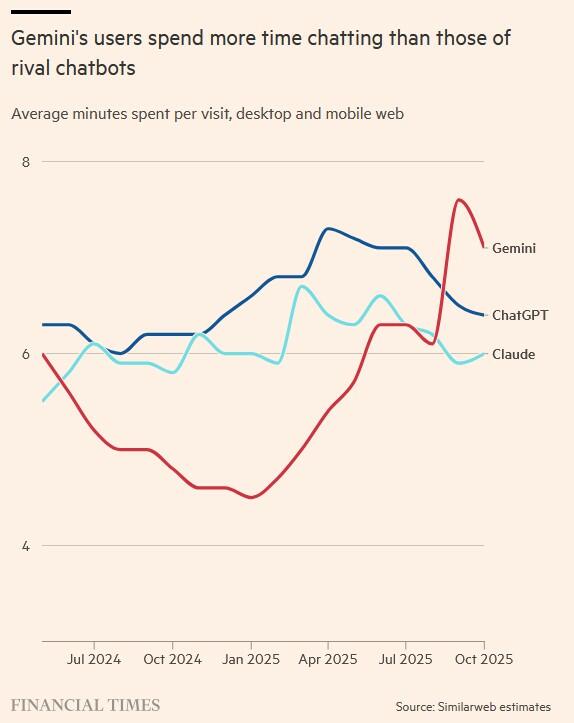

Industry coverage has flagged how rivals like Google and Anthropic have been adding features and catching up in popularity. The Financial Times noted the pressure on OpenAI after Google’s recent model release, suggesting rivals have narrowed the lead. That sense of urgency is one reason OpenAI is concentrating resources on ChatGPT now.

Google’s Gemini updates and related demos are being framed as meaningful technical steps, and insiders point to a “full stack integrated approach” as a big advantage. “Being able to connect with consumers, customers, companies, at that scale is really something that we can do because of that full stack integrated approach that we have,” said Koray Kavukcuoglu, Google’s AI architect and DeepMind’s chief technology officer. Google also highlighted gains from training on its custom tensor processing unit chips.

Gemini’s user numbers have reportedly jumped since August, with monthly active users rising from 450 million in July to 650 million in October. Anthropic is also gaining traction with business customers, making the competitive landscape more crowded. Those shifts add urgency for OpenAI to improve product metrics and retention.

OpenAI still faces structural challenges: it is not profitable and relies on rounds of fundraising to sustain growth, while big tech rivals can fund expansion from revenue. Analysts estimate OpenAI must scale revenue sharply, with some figures suggesting a need to approach $200 billion to be positioned for profitability by 2030. That math helps explain the company’s aggressive investment in compute and talent.

Experts privately note the dynamic has flipped from two years ago, when OpenAI led broadly across the space. “It’s quite a strong difference with the world we had two years ago where OpenAI was leading ahead of everyone else,” Thomas Wolf, co-founder and chief science officer of Hugging Face, said. “It’s a new world.”

Observers point to Google’s internal hardware and software integration as a structural edge, letting it train at scale without depending on third-party chips. That kind of vertical advantage changes how training costs and model performance line up across firms. It also raises the bar for startups that lack comparable infrastructure.

Market analysts argue the pressure is now on Altman to monetize effectively and keep multiple development tracks coordinated while controlling costs. “The pressure has definitely flipped to Sam Altman and his ability to monetise and keep all the plates spinning,” said Michael Nathanson. Investors and customers will be watching whether renewed focus on ChatGPT is enough to blunt competitive momentum.

The company’s next steps center on product fixes, operational discipline, and clarifying how paused projects will be phased back in. Daily engineering cycles and customer-facing polish are the immediate priorities. How quickly those changes translate into regained market advantage will determine OpenAI’s path forward.